When it comes to tracking invoices and payments, there are many ways to get the job done. While they all work, well, let’s just say some ways might challenge your sanity. Here are three scenarios different contractors faced and how they decided to track invoices and track customer payments.

Contractor #1 – Pen and Paper, Nothing Digital

The first contractor started his business on pen and paper and stayed using pen and paper. He felt no need to shake things up and track payments electronically. He would print a copy of the invoice, then write on the invoice when a customer paid. What could go wrong?

Well, during busy times, sometimes he would forget to write down when a customer paid, which resulted in having to go through bank records to check if there was a deposit for the amount the customer owed. The goal was to find the lost payment instead of making a potentially embarrassing call to a customer asking for payment when payment had already been made, but poorly tracked.

There was also the issue of customers losing the invoice or forgetting to pay on time. Since customers are used to seeing electronic invoices with automated payment reminders, and even being able to pay bills automatically with their saved card on file, mailing payment was something way outside of their regular routine and easily forgotten.

Even though contractor #1 got the job done, his method of tracking payments is riddled with issues that challenge his sanity and slow the process down. During busy times, he has to rely on his memory and paper invoices that can easily be lost. Overall, it is a messy way to keep track of customer payments and can lead to his frustration and embarrassment.

Contractor #2 – Excel Tracking Sheet, Partially Digital

The second contractor chose to track invoices and customer payments in Microsoft Excel. For the most part, this was a “free” option since the contractor was already paying for a Microsoft Office subscription. There were also plenty of templates out that he could download and modify to his exact needs.

His method functioned a lot like pen and paper, but since he tracked all his important business data digitally, he could ditch the large filing cabinet at home. This not only freed up storage space, but also allowed him to access key customer information on the go and have a jump start on gathering all the business financial information required for tax season.

The biggest issue was the extra time required to key in customer information, invoice numbers, and payment details. During his busy season, sometimes he’d fall months behind on tracking and have to take time away from his family and friends to get caught up. In the end, contractor #2 did have a fairly robust record of customer payment tracking, but the time it took to manually consolidate records into one tool left him tired, overworked, and wondering if there’s a better way.

Contractor #3 – All-in-One: Estimate, Invoice, and Payment Software

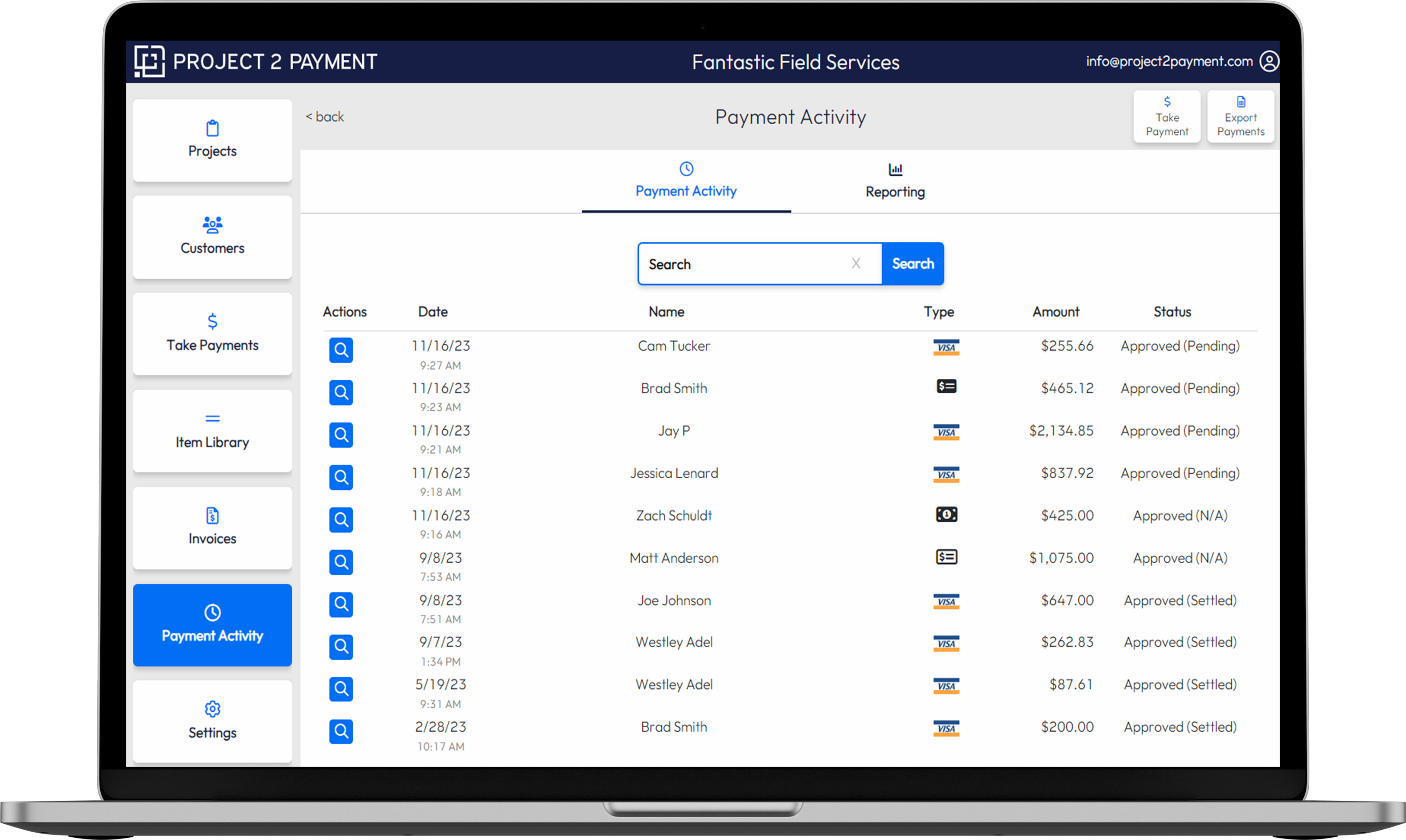

The third contractor decided to use Project 2 Payment, an all-in-one estimate, invoice, and payment software built specially for contractors. With the software, the contractor could create estimates and invoices, email them to customers with automated payment reminders, track unpaid invoices, and easily collect customer payments without having to switch from one tool to another.

Now, contractor #3 was not only able to find information on past projects easier and faster, but because he used a single tool from start to finish, he always had real-time data and reporting accessible from any device—including in the field. Because Project 2 Payment allows him to keep track of cash and paper check payments in the same place as digital payments, no matter how a customer decides to pay, contractor #3 is always on top of it.

When it is time to report end of month sales or get ready for tax season, with Project 2 Payment, he can easily pull a report to show what payments were received. Contractor #3 can also log in each day to see which payments are outstanding and set up automatic reminders to be sent to customers who are overdue on their payments. He decides how often the customer is contacted and when, and then Project 2 Payment does the rest.

Don’t continue using the same flawed systems when there’s a tool that can easily save you the trouble. With software like Project 2 Payment, customer payment tracking becomes nearly effortless. Keep customer, project, invoice, and payment records within one software and by doing so, keep your sanity, save time, and possibly even save money. Contact us to learn more.